The Limit, Save, Grow Act

Background information

In December 2021, Congress and President Biden raised the U.S. debt ceiling to $31.4 Trillion—this is the amount of money that the Federal Government is legally allowed to borrow.

On January 19, 2023, the United States reached that $31.4 trillion debt limit, setting up one of the most important legislative debates of 2023. If the Federal Government wished to borrow any further money, it would require Congress and President Biden to agree to another raise to the debt ceiling.

With Republicans in control of the House, and Democrats in control of the Senate and White House, there will be relatively few “must pass” bills that will make it to Biden’s desk and into law in 2023. An agreement on the debt ceiling was bound to be one of those bills.

Biden was quick to call for a “clean” raise to the debt ceiling—in 2023, Democrats want to raise the debt ceiling without making any spending reforms. But there is nothing “clean” about their plan, as raising debt without tackling spending is the dirtiest deal Washington could give the American people. Working Americans know that debt and spending are two sides of the same coin, and any solution to tackle the debt must also tackle spending.

In January, The Heritage Foundation and Heritage Action rallied conservatives and set forth a framework for tackling debt and spending in a sound and practical manner.

Latest News - House Passes Conservative Framework

In Q1 of 2023, Grassroots conservatives rolled up their sleeves and called on Republicans in the House to “[cap] spending at fiscal year 2022 levels and institut[e] programmatic cuts, reforms, and pro-growth policies that offset the increase in the debt ceiling.”

And on April 26, 2023, the House passed H.R. 2811, the Limit, Save, Grow Act, a bill which largely follows the framework as set out by conservatives.

Heritage Action endorsed H.R. 2811 and added this vote to our legislative scorecard. (See how your representative voted on this bill.)

This is a monumental first victory for conservatives, but the fight is not over. Executive Director Jessica Anderson explains: “To avoid a default, greater inflation, and more economic chaos, the Senate must immediately bring up this spending reform package in its current form.”

About the Limit, Save, Grow Act (H.R. 2811)

The Limit, Save, Grow Act does four major things, saving $4.5 trillion over the next 10 years:

1. Controls Federal Spending:

- Ends Reckless Spending in Washington by capping the FY24 at FY22 levels

This is the same level of spending America was operating under at the beginning of January 2023.

Caps annual budget increases at 1% for the next 10 years. When accounting for inflation, this is a plan to further decrease federal spending in terms of real dollars.

2. Saves Taxpayer Dollars TODAY:

- Reclaims Unspent COVID Funds

Most of this funding has been sitting dormant for 2 years and no longer needs to be spent—especially since the COVID emergency authorization has been rescinded.

Defunds Biden’s 87,000 IRS Agents by repealing over $70 billion in IRS funding for harassing audits.

Repeals “Green New Deal” Tax Credits

Blocks Biden’s Student Loan Bailout, which is an unconstitutional forgiveness plan designed to pay off supporters of Biden’s agenda in higher education.

3. Grows the Economy:

Institute basic work requirements for programs like Supplemental Nutrition Assistance Program (SNAP), which would ensure those who receive the benefits work toward reentering the workforce and becoming self-sufficient.

Institutes the REINS Act, which establishes congressional authority in approving or disapproving regulations that significantly impact the economy.

Unleash American Energy with provisions of H.R. 1, the Lower Energy Costs Act, to speed up the gas/oil permitting process and strengthen American energy independence.

4. Prevents a default on the federal debt:

In conjunction with tackling spending, this bill addresses the immediate urgency surrounding the debt ceiling, providing for a responsible increase to the debt limit. The debt limit would be lifted through March 31, 2024 or by $1.5 trillion—whichever occurs sooner.

Next Steps

Neither President Biden nor Senate Leader Schumer have put forth a plan to tackle the twin problems of debt and spending. In fact, President Biden is not even pretending to try and solve the spending problem in Washington—he is actively calling for Congress to ONLY raise the debt ceiling.

Furthermore, the Democrat Leader of the Senate, Chuck Schumer, does not even have the votes to pass the Biden plan in the Senate.

Meanwhile House Republicans have put forth and passed an actual solution. The Limit, Save, Grow Act (H.R. 2811) addresses the root cause of America’s debt crisis by cutting spending and making pro-growth reforms. And as the Democrats have failed to pass anything, it is also the only solution in Washington that raises the debt ceiling to prevent an immediate crisis.

To stave off an emergency, Senate Leader Schumer must bring the Limit, Save, and Grow Act to a vote on the Senate floor; Refusal to act is unacceptable. Americans must call on every member of the Senate to vote “YES” and pass this bill.

TAKE ACTION: Call your Senator NOW and tell them to take up the Limit, Save, Grow Act. It’s time for the Senate to continue what House Republicans started.

Explainer Videos

Video # 1: What is the Debt Ceiling?

Learn More:

Heritage Action Executive Director and Heritage President: Congress Must Rein in Unaccountable Bureaucracy and Inflation in Debt Ceiling Debate

Heritage Action: KEY VOTE: “YES” ON The Limit, Save, Grow Act (H.R. 2811)

Heritage Action Scorecard: House vote on Limit, Save, Grow Act

Heritage Action Executive Director: House Sends Historic Spending Reform Package to Senate

The Heritage Foundation: Don’t Give an Inch on the Debt Ceiling

The Heritage Foundation: Federal Budget in Pictures

The Heritage Foundation: 6 Charts Show America’s Big Debt Problem

The Heritage Foundation: These 7 Charts Show Why Congress Must Get Spending Under Control Immediately

The Heritage Foundation: Heritage President Speaks to Media on Biden-McCarthy Debt Limit Negotiations

Key Points

The debt ceiling is an important tool to protect the American people. The debt ceiling isn’t the problem—reckless spending is the problem. The debt ceiling is a tool to force Congress to develop a solution (a better budget to control spending).

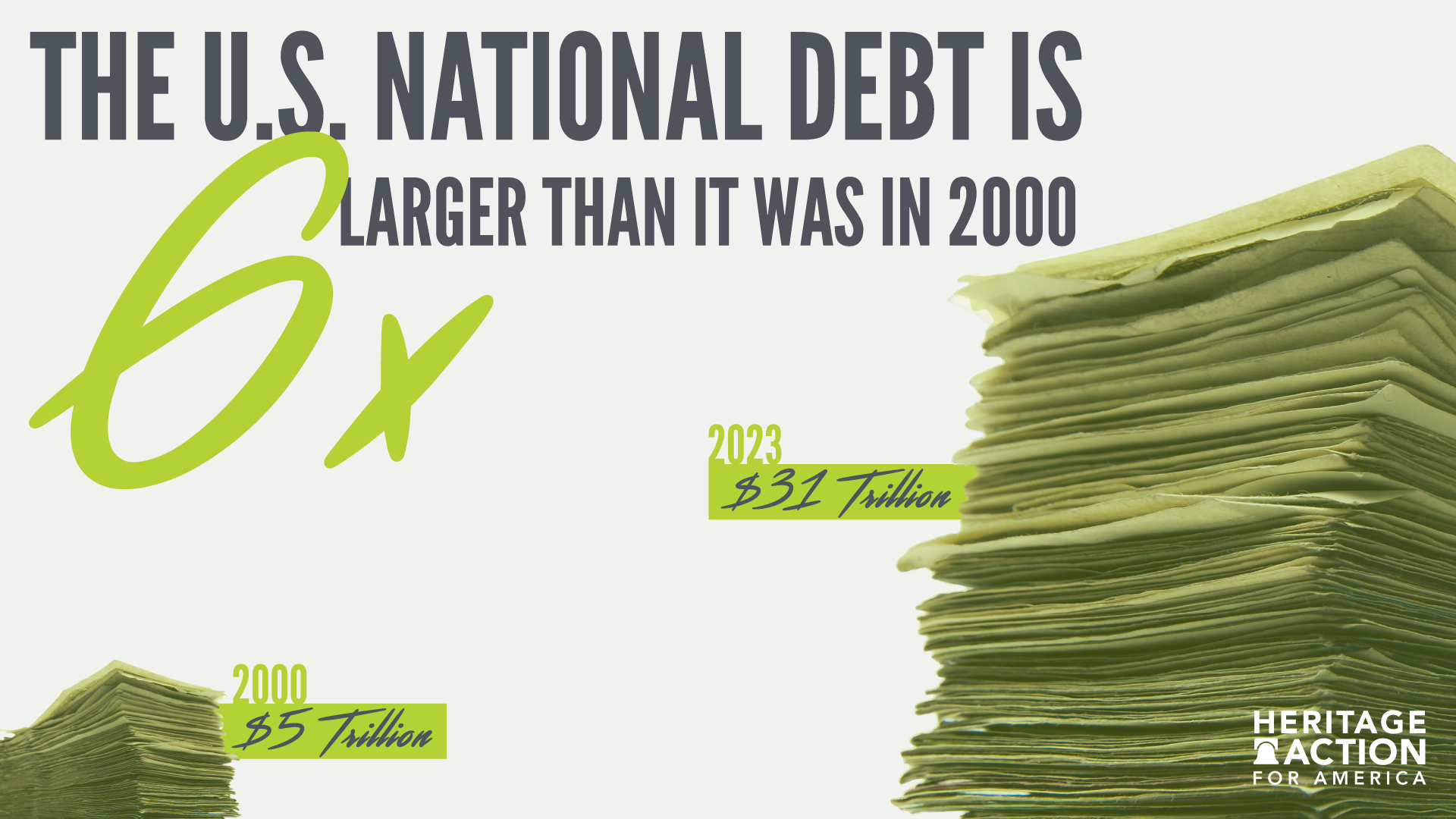

Federal spending is out of control. The current national debt is six times what it was in 2000. This exponential increase will only get worse if we don’t make serious changes very soon.

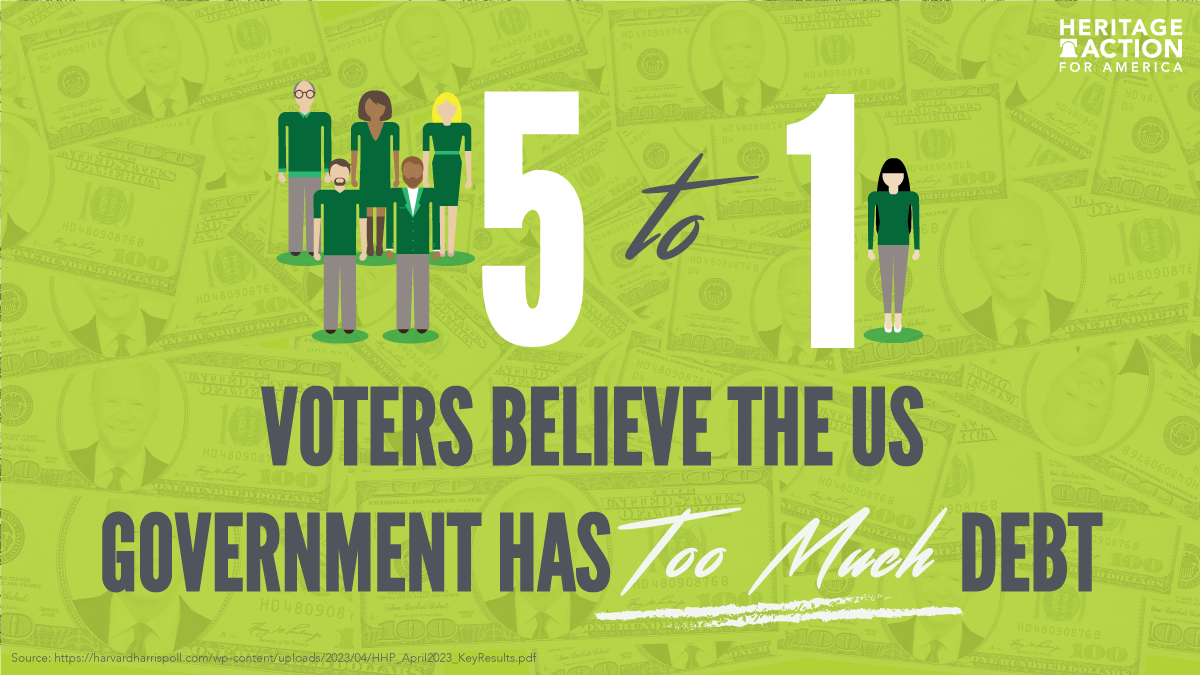

Americans are ready for change when it comes to national debt and spending. 84% of Republicans and 68% of Democrats believe that strengthening the economy should be a top priority for Biden and Congress.

House Republicans have passed the Limit, Save, Grow Act—a bill that would actually fix the spending problem in Washington. In contrast, President Biden refuses to even put forth a plan to cut or reform spending—President Biden wants to raise the debt ceiling without making any effort to control Washington’s spending addiction.

The Limit, Save, Grow Act is the only solution. If Democrats were serious about restoring fiscal sanity in Washington, they would immediately bring this bill to the Senate floor for a vote. And if Democrats are sincerely concerned about a default on the national debt, then they should immediately pass this bill in the Senate and send it to President Biden’s desk.

Social Posts (remember to insert the social handle of your member)

President Biden and Senate Democrats aren’t serious about preventing a national debt crisis. If they were, they’d be talking about reining in spending too. Here’s what a responsible solution looks like.⬇ https://heritageaction.com/toolkit/stop-the-spending

President Biden wants a “clean” debt ceiling increase, but raising the debt ceiling with no spending reforms would be the “dirtiest” deal for Americans. But House Republicans have already passed a REAL solution to tackle debt and spending. The Senate must immediately take up this critical legislation ⬇ https://heritageaction.com/toolkit/stop-the-spending

It’s time for smart spending. House Republicans passed a responsible bill that limits government spending and promotes growth for the economy. It saves $4.5 Trillion over 10 years. Now the Senate needs to take up the fight and pass the Limit, Save, Grow Act.

The Limit, Save, Grow Act will: ✅Prevent a Default on the National Debt ✅Limit Government Spending ✅Save Taxpayer Dollars Today ✅Control Government Spending in Future Years ✅Grow the Economy The House has already passed it. Now it’s @SenSchumer’s turn in the Senate.

Graphics