Budget Reconciliation

Background information

In order to deliver on his mandate and usher in a new American Golden Age, President Trump must have support from Congress. This can be accomplished by passing H.R. 1, the “One, Big Beautiful Bill Act” — a budget reconciliation package that implements major reforms to rein in bureaucratic waste, fraud, and abuse and provides the White House with the tools necessary to carry out a true America First agenda.

In May, the House of Representatives passed H.R. 1. The bill includes real and significant wins for the President and the American people, and should be improved on even further. As H.R. 1 moves to the Senate, it’s vitally important lawmakers ensure the “One, Big Beautiful Bill” delivers for the American people.

What is budget reconciliation?

Budget reconciliation is a powerful tool conservatives can use to turn their policy ideas into law during the 119th Congress. Typically, 60 votes are required to pass legislation in the Senate (a 3/5 majority). However, budget reconciliation allows them to bypass the Senate filibuster and enact reforms into law with only a simple majority (51 votes) in the Senate. That is what makes it so powerful.

Budget reconciliation is a legislative process that allows Congress to change laws on:

1) taxes (and other types of “revenue”)

2) spending (called “outlays”)

or 3) the debt limit to bring spending and revenue in line with the priorities laid out by the annual budget resolution. Lawmakers, in other words, set out to “reconcile” existing law with their latest priorities. It’s an optional step of the annual budget process, and is separate from the appropriations and government funding process.

>> Read more about how the budget reconciliation process works

Not every reform can be passed using budget reconciliation, given its special rules. However, though reconciliation is geared towards budgetary items, it can be used creatively to pass legislation on a wide variety of topics.

Additional Resources from Heritage Action:

Additional Resources from The Heritage Foundation:

Fact Sheet: Budget Reconciliation Priorities for the 119th Congress

Report: An Education Reconciliation Agenda for the 119th Congress: 12 Reforms

USA Today: Trump’s tariffs are only the start. Congress must now cut taxes and regulations.

Commentary: Trump Administration Puts Subsidized Green-Energy Companies on a Diet

Special Report: What If the Trump Tax Cuts Expire? A Primer on What Is at Stake

Key Points

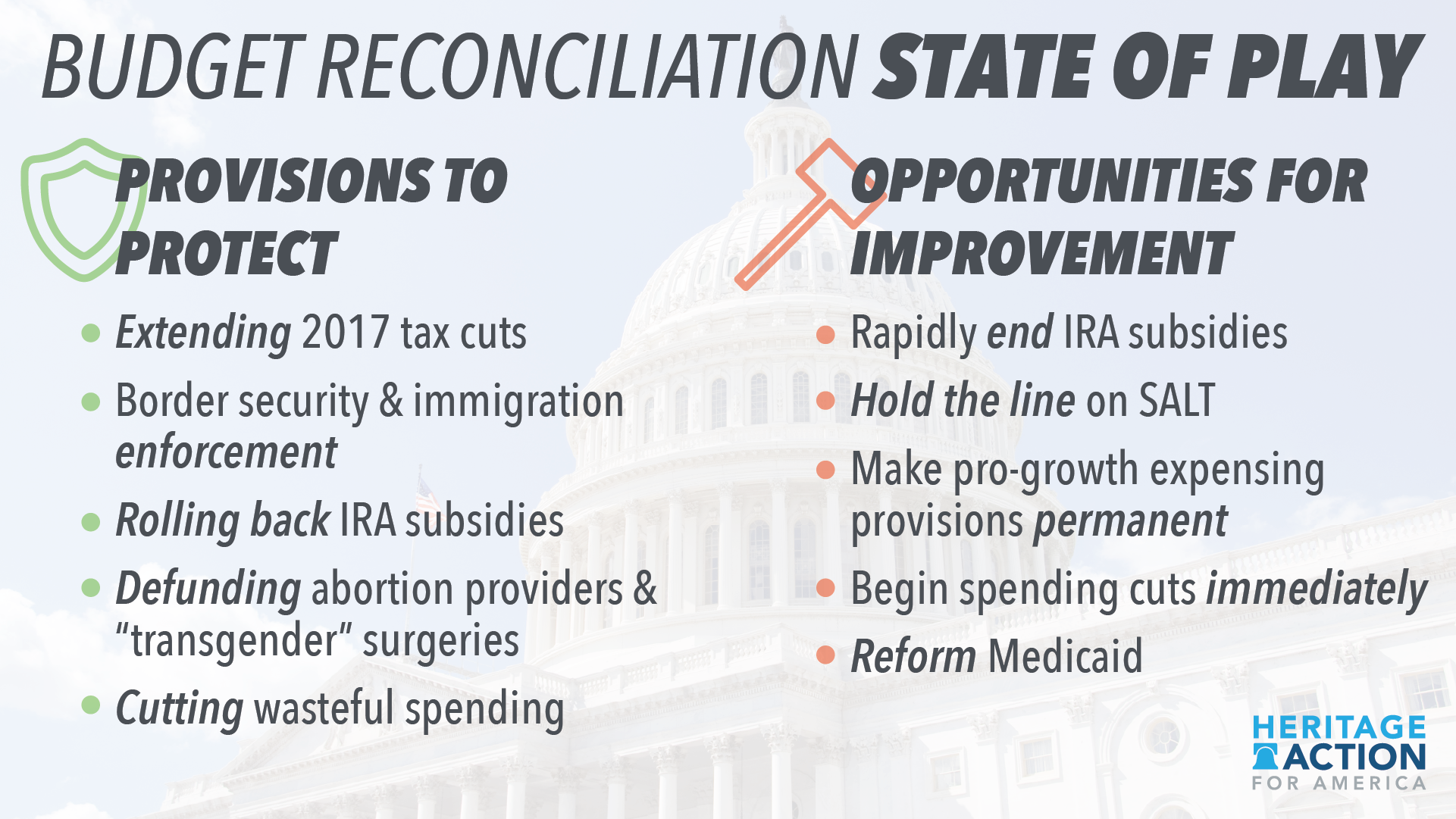

Important Provisions to Defend:

President Trump’s “One, Big Beautiful Bill” accomplishes his top priority: putting the needs of the American people over the wants of special interest groups. Here’s how:

It cuts taxes: Extends the 2017 tax cuts, boosts expensing for capital investments in factories, reduces job training tax penalties, and cuts corporate charitable deductions to curb taxpayer-subsidized donations.

It provides more resources to secure the border and ramp up deportations: Supports ICE operations to deport one million illegal immigrants annually, doubles the number of detention beds, hires 10,000 new officers, increases immigration judge totals, and finishes the border wall.

It scales back the Inflation Reduction Act: Phases out Biden-era Green New Deal tax credits that are disrupting the grid and killing jobs.

It reforms the broken student loan system: Eliminates Grad Plus Loans, repeals Biden’s unlawful loan repayment plan that would have cost taxpayers $220 billion, rolls back several burdensome and costly Biden-era regulations, limits the Secretary of Education’s ability to bypass Congress and make significant policy by regulation, and holds colleges accountable for unpaid student loans from high-cost, low-value degrees.

It protects life: Defunds big abortion providers like Planned Parenthood which will save millions of preborn lives.

It slashes woke and wasteful spending in the federal budget: Strengthens Medicaid and Obamacare eligibility checks to ensure taxpayer dollars are going to Americans who need it most, establishes work requirements for Medicaid and improves work requirements for SNAP, codifies employer health reimbursement rules, expands Health Savings Account options, reverses the Biden-era EV mandate, and ends Medicaid-funded sex changes.

Opportunities for Improvement:

While this legislation includes real and significant wins, there is work to be done on important components of the bill. This includes:

Repealing all of the IRA subsidies. The bill should go further and repeal all the subsidies immediately, so energy is cheaper and more reliable. (Why Electricity Prices Are Soaring in Blue States)

Holding the line on the state and local tax deduction (SALT) cap. Congress should reduce the cap (currently at $40,000 in the House bill, a significant increase from the current $10,000 limit), and focus on expanding permanent pro-growth tax cuts. (Too Much SALT Could Ruin the ‘One Big, Beautiful Bill’)

Making the business expensing provisions permanent. Congress should ensure the most pro-growth tax portions of the TCJA are made permanent. (Extending the Trump Tax Cuts’ Small Business Provisions Is Critical for Main Street)

Beginning spending cuts immediately. Spending cuts should take effect immediately, so that a future Democrat-controlled Congress or Administration could not undo them.

Reforming Medicaid. We should focus resources more fairly on the most vulnerable Americans who need assistance. (Commonsense Medicaid Reforms for 2025)

Call Notes

My name is [NAME] and I am a constituent from [CITY, STATE].

I am calling to urge [SENATOR] to work with President Trump and ensure the “One, Big Beautiful Bill” works for the American people by protecting the victories in the House-passed bill and improving it even more.

The bill extends many key tax cuts, provides more resources for border security and ramping up deportations, reforms the broken student loan system, and slashes woke and wasteful spending.

To make the “One, Big Beautiful Bill” even stronger, the Senate should repeal all Inflation Reduction Act subsidies starting immediately to make energy cheaper and more reliable.

The Senate should also improve the bill by making business expensing provisions permanent to boost growth and help Main Street.

Senators can also ensure that we refocus resources on the most vulnerable Americans that need assistance by including additional reforms to Medicaid.

Lastly, Senators should reduce the cap on the State and Local Tax (SALT) Deduction. Taxpayers in red states should not have to pay for the radical, wasteful policies of blue states.

This is a once in a generation chance to help return our nation to greatness, and failure cannot be an option.

Please tell [SENATOR] to use this opportunity and build upon the foundation that the House laid to pass a transformative reconciliation package that works for all Americans.

Thank you.

Social Posts (remember to insert the social handle of your member)

.@POTUS's One Big Beautiful Bill puts America first: 💰 Cutting taxes 🧱 Securing the border & ramping up deportations 📚 Reforming the broken student loan system 🍼 Protecting life ❌ Slashing woke & wasteful spending in the fed's budget @SenateGOP maintain these priorities!

To deliver on his mandate, President Trump must have the support of Congress. @SenateGOP must unite to pass the One Big Beautiful Bill Act, ushering in the American Golden Age.

While the One Big Beautiful Bill makes monumental strides, there is still important work to be done: ⚡Repeal all IRA subsidies 📈Expand & make permanent pro-growth tax cuts 💰Make TCJA permanent 📉Begin spending cuts immediately 🏥Reform Medicaid–focus on the most vulnerable

Graphics