*Last updated January 09, 2025

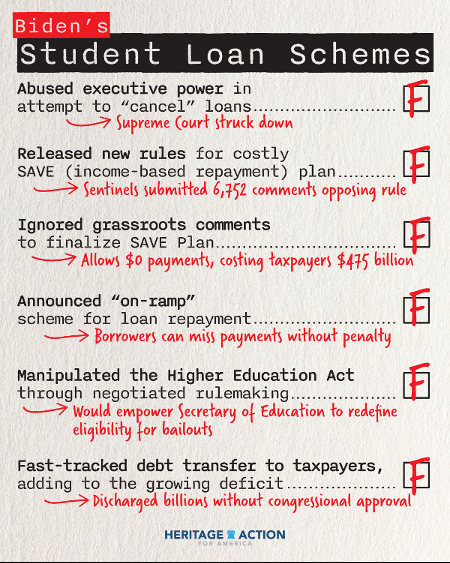

President Biden has been peddling student loan “forgiveness” since he was a presidential candidate. While the initial student loan cancellation scheme Biden announced in August 2022 was found unlawful by the Supreme Court, Biden and his administration do not give up easily in their fight to use unconstitutional executive overreach and your money to pay off voters in an election year.

The administration has launched repeated new schemes to circumvent the Supreme Court’s ruling and encourage borrowers not to repay their debts. These schemes are not only illegal, but the concept of “transferring” student debt is a fallacy, and, in every respect, unfair. At its core, student loan “forgiveness” is a socialist policy. It knowingly penalizes hard-working, taxpaying Americans to support a privileged few who chose to take on debt.

In the short-term, trillion-dollar government spending sprees are obviously destructive, but assigning debt onto non-borrowers (or previously responsible ones) and absolving interest will have a consequential impact on financing higher education. With the government greenlighting colleges’ predatory pricing and putting none of the financial risk on these institutions, they will gladly continue to hike tuition. Such fiscally irresponsible policy will have devastating, long-term economic impacts as universities receive all the upside benefits while avoiding all the downside risk.

The big lie of student-loan “forgiveness” is that debt can be forgiven—but it can only be transferred, not erased. The result is a financially unsustainable cycle where tuition rates skyrocket, debt spirals, college grads advocate for special treatment, and the government hands you the bill!

How We Got Here: A Summary of Biden’s Debt-Shifting Schemes

Since taking office, President Biden has made several attempts to undermine the law and punish taxpayers in the name of student loan “forgiveness.” These efforts can be generally categorized into four attempts.

ATTEMPT 1: Exploiting Emergency Powers in the HEROES Act

In August 2022, Biden announced he would cancel $10,000 in student-loan debt for each borrower, or $20,000 for Pell Grant recipients. To qualify, the debtholder would need to earn less than $125,000, or less than $250,000 if the borrower files taxes as married or as head of household. Biden tried to justify this sweeping change under the emergency powers of the HEROES Act, a post-9/11 law intended to give servicemembers temporary reprieve from loan repayments while deployed overseas. The plan was legally dubious and lacked any consideration of economic consequences.

After this alarming announcement, several states rightfully sued the Biden administration and the Department of Education (ED) in September 2022, alleging that Congress never approved the massive student loan bailout scheme and calling out the Biden administration’s explicit misuse of the HEROES Act. Although the law vests the Secretary of Education with the authority to amend student loan rules during emergencies, it does not authorize an extensive rewrite of existing law. Furthermore, by the time Biden announced this plan in August 2022, the stated emergency that would supposedly justify this action — the Covid-19 pandemic — had long since passed.

In October 2022, student loan cancellation applications opened, despite the legal infirmities of the policy. By November 2022, there were multiple lawsuits, dismissals, and appeals, and ED changed its rules multiple times to try staying out of court.

Despite their efforts, the Supreme Court’s June 2023 ruling clarified that Biden’s unprecedented move to redline hundreds of billions of dollars’ worth of debt — bypassing Congress and forcing taxpayers to foot the bill — was, in fact, unlawful. This failed attempt has been estimated to cost $400 billion.

ATTEMPT 2: Reducing Owed Debt through Repayment Delays

In response to the Supreme Court’s ruling, the White House released an announcement in June 2023 stating it would institute a 12-month “on-ramp” to repayment, running from October 1, 2023 to September 30, 2024. During this grace period, borrowers who miss monthly payments would not be considered delinquent, reported to credit bureaus, placed in default, or referred to debt collection agencies — another legally unsound move reeking of executive overstep. It is estimated that as a result of extending this student loan payment pause, it has effectively cost taxpayers $258 billion.

ATTEMPT 3: Rewriting Repayment Rules: REPAYE-to-SAVE Plan

In January 2023, knowing its first attempt was in legal jeopardy, ED released new rules under the Higher Education Act (HEA) for student loan repayment evasion. This scheme transformed the income-driven repayment (IDR) program known as REPAYE into a debt forgiveness program by redefining the vast majority of borrowers as financially distressed. As a result, millions of borrowers will get a majority of their loans canceled on the backs of 100 million taxpayers. This new version of REPAYE halved the monthly payment from 10 percent to 5 percent of non-exempt income, and it increased the amount of exempt income from 150 percent to 225 percent of the federal poverty line. For many borrowers, the regulation reduced the amount of time before any remaining debt is fully “forgiven” by taxpayers from 20 to just 10 years.

Heritage Action pushed back by activating our network of grassroots activists to submit public comments in opposition to this new regulation. Heritage Action grassroots submitted a total of 6,752 comments — 12 percent of the total submitted — to push back against Biden’s egregious abuse of executive power.

Despite the concerns of Americans, Biden announced the final version of REPAYE, called the Saving on A Valuable Education (SAVE) plan, in July 2023 — estimated to cost taxpayers $560 billion. The final rules rejected thoughtful comments submitted during the open comment period that insisted the program is meant to help only distressed borrowers and asked the department to consider the costs to taxpayers. By early November 2023, ED reported that two million college alumni had already switched to SAVE and that the majority of SAVE borrowers had a monthly payment of $0 under the new terms.

Because the Biden administration failed to remedy the various issues related to their current loan repayment plans, they proposed a new initiative under the SAVE plan in July 2023 that would fast track the transfer of $39 billion in student debt to American taxpayers. In January 2024, Biden’s Department of Education approved the cancellation of an additional $5 billion in additional student debt through more fraudulent IDR account adjustments, under provisions of the SAVE Plan.

Every few months, Biden’s ED has worked to absolve billions of dollars for hundreds of thousands of borrowers, prioritizing those who work in government jobs. The first $5 billion wave of “forgiveness” covered the debts of 74,000 borrowers. In February 2024, the Biden administration announced the approval of another $1.2 billion in student debt transfer for almost 153,000 borrowers currently enrolled in the SAVE repayment plan. In May 2024, the administration announced another $7.7 billion in debt transfer for 160,000 loan holders. At this rate, the Biden administration is on track to discharge hundreds of billions without congressional approval, transferring the debt to all American taxpayers—the majority of which did not go to college—while adding to the growing deficit and posing significant costs to working-class families.

Over a dozen states sued to block Biden’s student loan handouts in April 2024, on the basis that the SAVE Plan illustrates a recurrent and concerning trend: the President abusing his power to enforce significant, expensive policy shifts on Americans without their approval. In the Eighth Circuit lawsuit, filed in Missouri, the appeals court temporarily blocked the SAVE plan. In August 2024, SCOTUS denied the Biden-Harris administration’s request to lift the block, delivering another legal blow to the student loan transfer scheme.

ATTEMPT 4: Exploiting the Higher Education Act – Broadening Eligibility for Cancellation through Rule-Making

During the summer of 2023, the Department of Education explored another strategy to sidestep the law, usurp power, and once again manipulate the Higher Education Act to cancel student debt. This effort takes a different approach to rewriting the regulations in the Higher Education Act and gives the Secretary of Education new powers to unilaterally cancel loan obligations.

After a months-long process known as negotiated rulemaking needed to establish this new debt-cancellation power, the Biden administration unveiled its new plan in April 2024.

The proposed regulation overwhelmingly broadens the scope of eligibility for debt cancellation. It encompasses individuals who have significant accrued interest, applicants who meet existing cancellation program criteria but have not yet applied, and individuals who did not complete their degree due to underperformance or fraudulent activities. Additionally, borrowers who began repaying undergraduate loans before 2005 or graduate loans before 2000 may qualify for full debt cancellation. Many of these borrowers are now at least 20 years into their careers, so their earning potential likely far exceeds their early post-college income.

If successful, this rule would eliminate up to $20,000 in unpaid interest, regardless of income being too high to participate in an income-driven repayment plan, for two million Americans. For those eligible to participate in an income-driven repayment plan, all unpaid interest would be forgiven for those with an income of $120,000 or less if filing single or $240,000 or less if filing jointly. This would include widespread cancellation for about 23 million Americans. With an estimated cost nearing $1 trillion when combined with previous efforts, this poorly targeted scheme invites the opportunity to transfer debt from individuals who willingly took out loans onto hard-working Americans, two-thirds of whom do not have college degrees.

In true Biden style, this expansive extension of presidential authority was granted only a brief 30-day public comment period on the rule. Unsurprisingly, there was a large outpouring of public opposition to the regulation. Heritage Action’s grassroots were responsible for submitting 19,503 comments—a whopping 16% of all comments submitted!

On December 20, 2024 the Biden Administration withdrew this notice of proposed rulemaking and terminated the rulemaking proceeding, marking the end of its attempt of canceling student loans in this specific way.

As part of the same negotiated rulemaking efforts through the Higher Education Act (HEA), the Department of Education issued a separate Notice of Proposed Rulemaking (NPRM) on October 31, 2024 regarding canceling student loans for borrowers experiencing "hardship". There would be two pathways for this cancellation: one-time, automatic cancellation and application-based ongoing cancellation . One-time automatic cancellation would be awarded if it was deemed that the borrower would have an 80% chance of default within two years of the regulation’s publication date using 17 arbitrary hardship factors such as household income, assets, types and balances of student loans, debt balances, and required payments to household income. The proposed rule also states that the secretary of education would be able to identify “any other indicators of hardship.” This raises concerns about a potential “moral hazard” as it could include factors like “high auto loan or credit-card payments” as qualifying hardships. Application-based ongoing cancellation would be based on a holistic hardship assessment with the conclusion that “the hardship is likely to impair the borrower’s ability to fully repay the Federal government or the costs of enforcing the full amount of the debt are not justified by the expected benefits of continued collection of the entire debt.” This proposed rule is estimated to cost $600 billion according to the Committee for a Responsible Federal Budget, making the new plan more expensive than any other proposed by the Biden-Harris administration.

On December 20, 2024 the Biden administration also withdrew this notice of proposed rulemaking and terminated the rulemaking proceeding, effectively giving up on canceling student loans using this particular method.

The Road Ahead

These are just the four biggest schemes. In addition to these, Biden’s Department of Education has worked overtime searching for other avenues to transfer student debt onto the backs of working taxpayers. This includes significantly loosening regulations for other existing repayment programs and counting non-payments as payments (thus canceling interest and enabling overall debts to be canceled sooner than the law allows).

The incompetence of the Office of Federal Student Aid compounds the confusion for borrowers and loan servicers. While servicers try to figure out how much students owe, many loans are being placed in administrative forbearance; servicers are starting to be penalized, and borrowers’ nonpayments are being credited as $0 “payments” toward eventual cancellation.

So far, Biden has tried and failed to transfer debt through the HEROES Act; extended the pause on repayment via administrative delays and its “on-ramp” scheme; rejected substantive public comments on the REPAYE-to-SAVE rule; and attempted to grant the Secretary of Education new authorities to redline debt at taxpayers’ expense.

Although the legal landscape has been encouraging thus far, the courts need plaintiffs to challenge the latest unlawful schemes. Ultimately, Congress should rein in Biden’s recklessness. Given the lawlessness of the U.S. Department of Education, Congress should require any new regulations expanding debt cancellation to get congressional approval. They should also use Congressional Review Act (CRA) resolutions to vote to overturn attempts at debt forgiveness rulemaking.

Given the volume of public comments submitted against Biden’s student loan cancellation agenda already, it is clear that this issue is of considerable importance to the American people. As always, we must hold the line to uphold the law and ensure taxpayers do not bear the brunt of debts they do not owe.